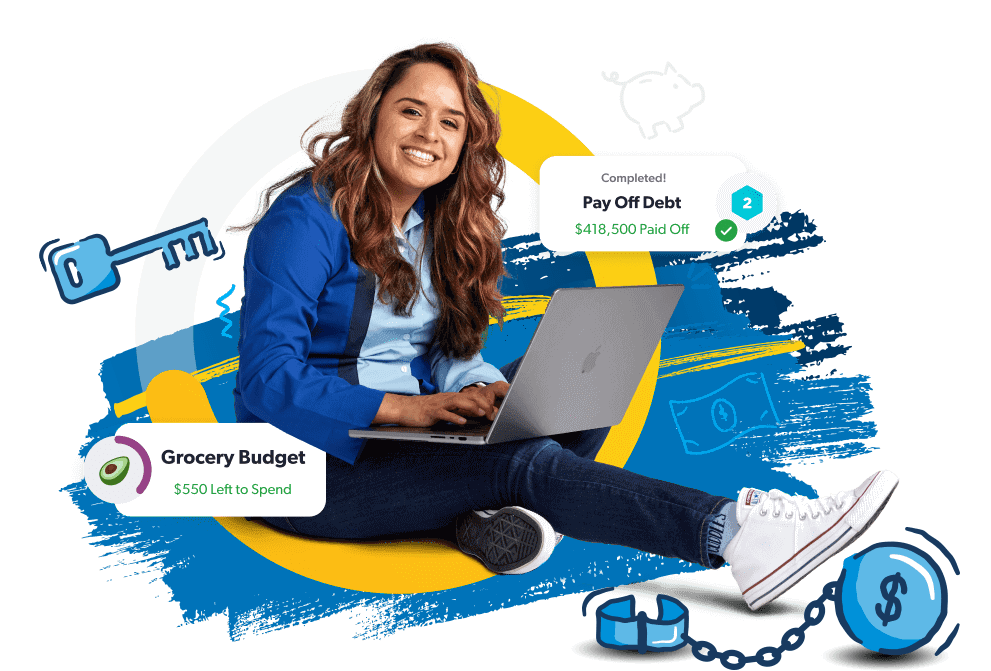

Making payments for things you bought in your past is like chaining weights to your ankle. You can’t invest in the future when you’re locked up in debt. A budget helps you free up your income fast.

Budget Your Way to Zero Debt

No matter your age, your profession or your income, sticking to a monthly budget is hands down the (not-so) secret tool to paying off debt fast and building wealth. It helps you manage where every dollar of your income is going. Below are your next steps.

List Out Your Debt

List all your monthly expenses including debt and loan payments. You’ll need this handy for step 2.

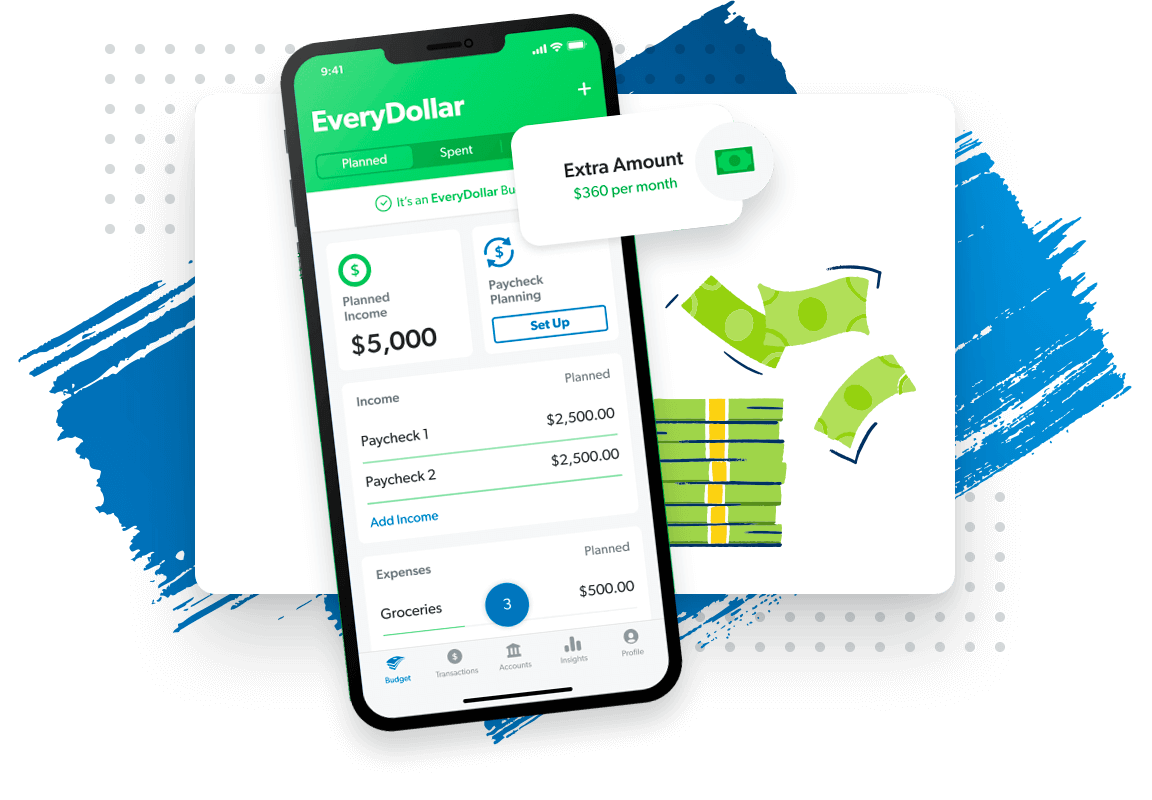

Create Your Free Budget

Forget complicated spreadsheets. Here’s an app that makes things easy for you and it’s free—the EveryDollar budget app. Once you download the app, you’ll plug in your expenses (from step 1) and the app does all the calculations for you.

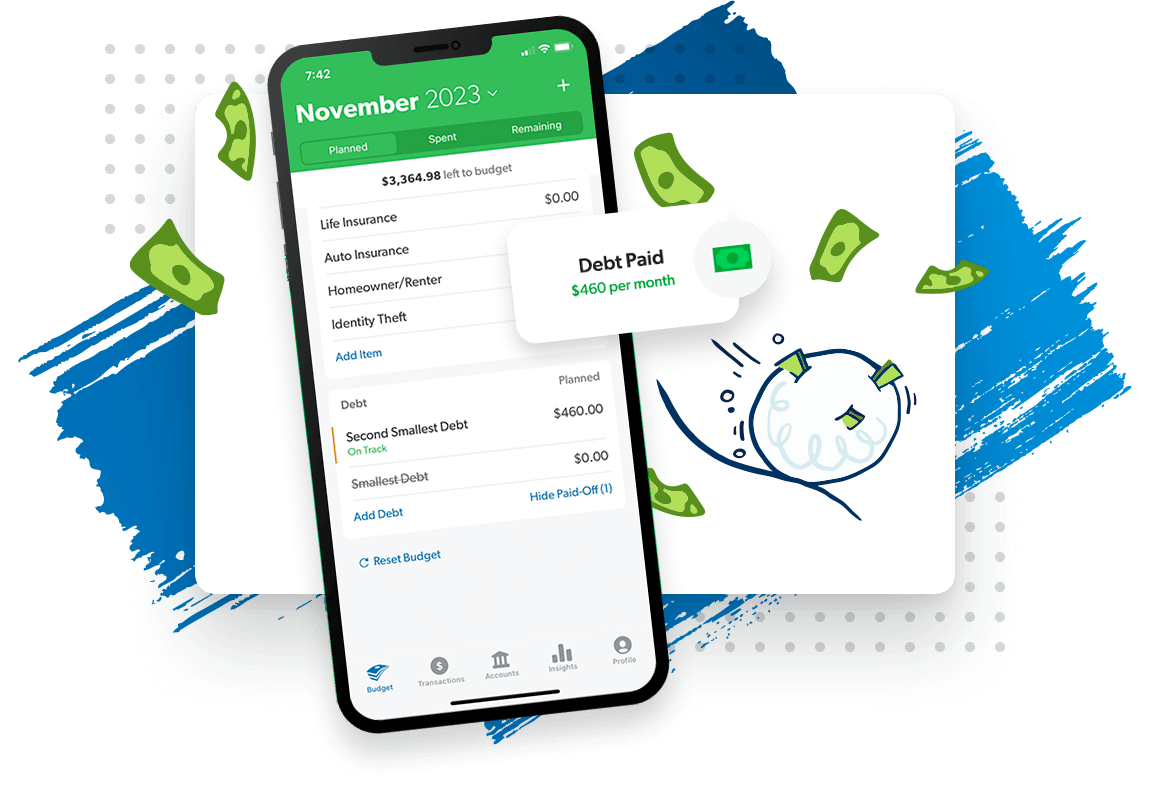

Tackle Your Debt

Now, it’s time to take back your money! You’ll start attacking debt from the smallest to the largest until all debt is paid off. You’re on your way to no more debt payments—ever!

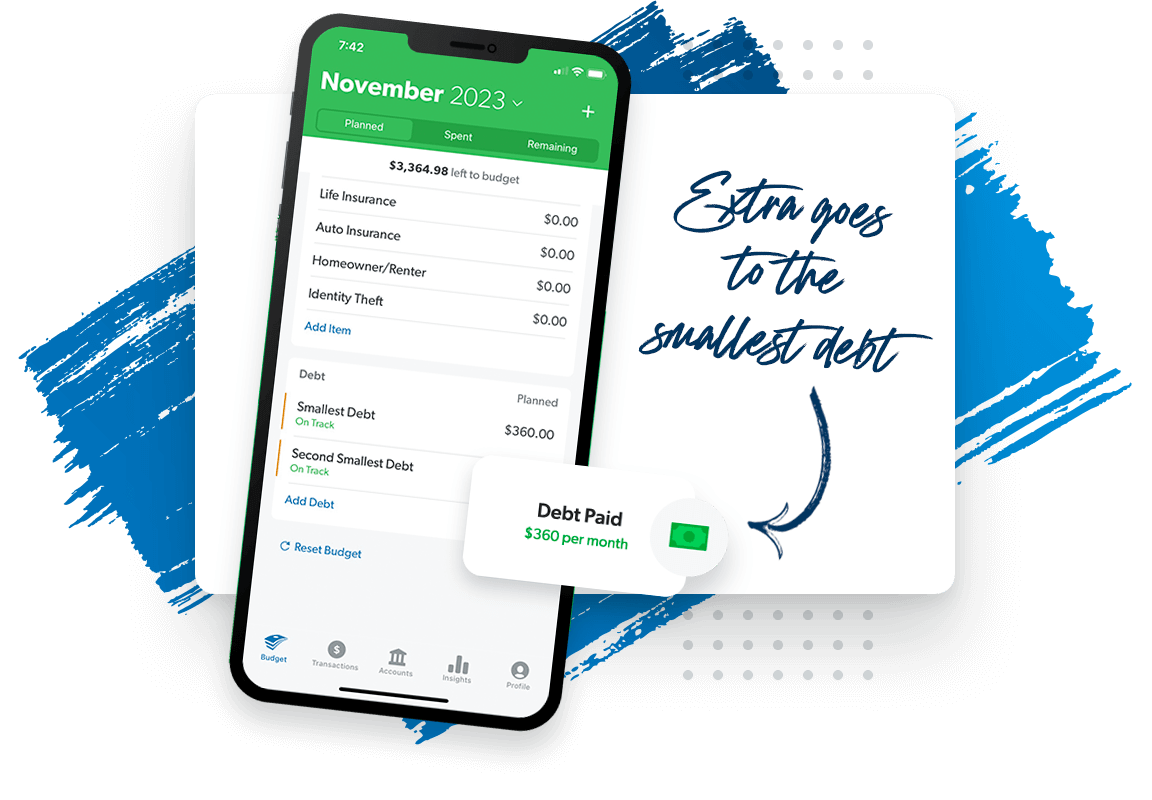

Find More Money

Once you start budgeting, you may find extra money available to put toward paying off your debt.

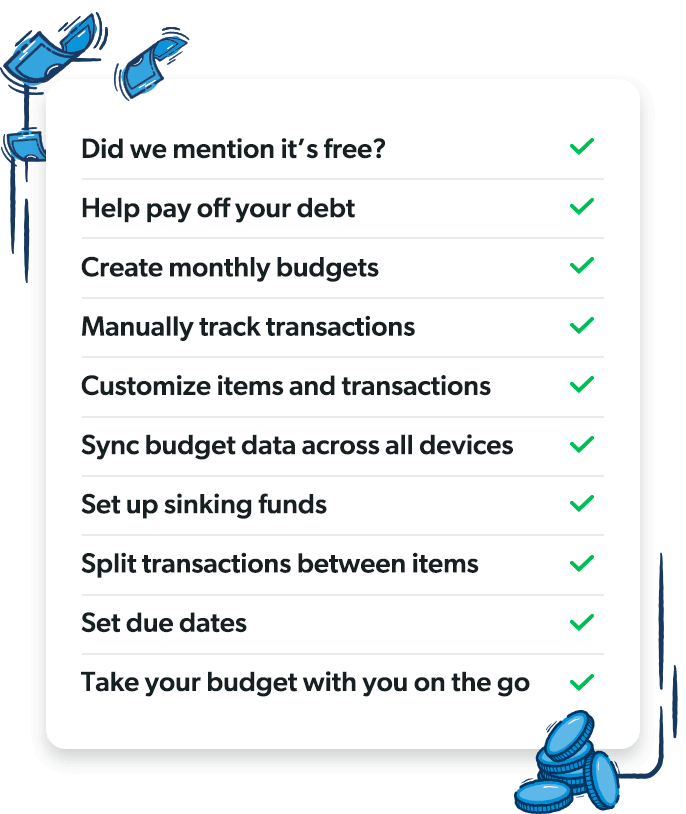

EveryDollar Budget App Benefits

Let’s address the elephant in the room—yes, the budgeting app is free. Really. And best of all, a budget puts you in charge of your money. Goodbye, money stress. Hello, money goals!

Save $1,000 for Your Starter Emergency Fund

Your starter emergency fund of $1,000 (Baby Step 1) will cover an unexpected life event you can't plan for. Cash-flowing your emergency keeps you from digging a deeper hole while you’re budgeting your way out of debt!

The Debt Snowball Method

Using what we call the debt snowball method (Baby Step 2), you’ll pay off your smallest debt first while paying minimum payments on the rest. Once the smallest debt is paid off, roll that payment toward the next smallest debt. Repeat like a snowball that’s rolling downhill.