Analysing the behaviour trends of customers and their payment habits has led banks to realize the plethora of benefits that the Buy Now Pay Later model offers. Despite being a fintech feature, the BNPL model is increasingly helping banks to expand their customer base, especially cash-strapped Millennials and Gen Z, many of whom neither have a credit card, nor a credit score. Let us understand how this model works and can benefits banks.

Understanding BNPL

BNPL, also known as Pay in 4, refers to short-term financing that allows customers to make purchases and split the total payment into multiple periods. Fixed, interest-free payments (if paid on time) allows customers full ownership of the purchase, unlike traditional deferred payments. BNPL is different from the traditional credit model, as it focuses on boosting sales through fast approvals, rather than on the customer’s ability to repay loans.

On behalf of the buyer, the BNPL provider settles the amount with the merchant in full. It allows for customers to use finance agreements to pay for items over time without incurring interest charges.

Banks getting into the BNPL game is almost inevitable as instalment credit is a natural fit for financial institutions, who have more data about BNPL customers than pure-plays. The Buy Now Pay Later business model hit new heights in 2021 as consumers embraced flexible payments and sought to limit credit card use — the number of US BNPL users increased 81.2% YoY in 2021, according to Insider Intelligence estimates.

The pandemic’s impact, along with BNPL’s widespread appeal, will drive worldwide transaction volume to $680 billion by 2025. According to Insider Intelligence, this is a 13.23% CAGR from the $285 billion predicted in 2018. Moreover, nearly 40% BNPL users in a recent survey by C+R research said BNPL would eventually replace their credit cards. This perhaps explains the attention BNPL firms like Affirm, AfterPay, and Klarna are getting.

How banks are financing BNPL

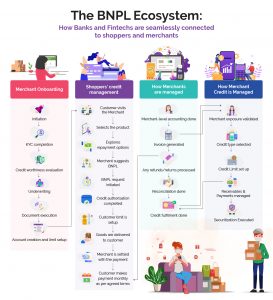

In the Banking-as-a-Service (BaaS) age, BNPL has revolutionised consumer credit and instalment loans by being entirely integrated into the customer buying cycle to give consumers a seamless digital experience and convenient access to finance at the point of purchase.

Some banking technology providers are beginning to combine the power of BNPL solutions and virtual cards, thereby helping banks kill two birds with a stone – drive revenue and strengthen customer loyalty. However, rather than flipping a card transaction into BNPL afterwards, banks can drive more sales conversions when they present a pre-purchase BNPL option to customers.

Since banks already have data on their customer’s financial behaviour, they can tailor BNPL offerings based on the risk profile.

McKinsey states key differentiators of BNPL providers include transforming their apps into shopping apps, thereby offering solutions that cover the entire customer journey; offering enhanced rewards programs, helping them grow their share of revenues from affiliate marketing and advertising; treating the merchant check-out as a low-cost customer acquisition channel; and, advanced tech, that includes distinctive merchant underwriting, AML, integrations into shopping carts, and top-notch consumer-service tools.

Banks may also need to reposition themselves as merchant and shopper-friendly, thereby changing the perception merchants have, making them more likely to approach them for business.

Another way banks can gain is by targeting vertical-focused larger ticket plays, such as home-improvement, dental, dermatology or veterinary. By offering Buy Now Pay Later services in this space, banks will be able to acquire high-credit customers and cross-sell mortgage refinancing and other banking services.

How do banks and fintechs benefit from BNPL?

Source : The Ascent , a Motley Fool service

Fintechs benefit from faster client and merchant acquisition, lower credit risk, and more transactions. Banks can increase customer engagement, wallet share, and loyalty by offering seamless, convenient shopping experiences. BNPL can benefit incumbent banks that can use existing strengths, such as better loan term and condition flexibility and increased capital utilisation owing to quicker loan turnover and lower regulatory capital requirements. BNPL also provides cross-selling opportunities to bank and non-bank customers who are likely to be more engaged.

As far as customers are concerned, even though they pay in instalments, they gain full ownership of the product. The fixed payments help them budget their expenses. Customers also tend to prefer BNPL for purchases under a threshold such as $500, and anything over that, they prefer instalment plans that can stretch up to a year.

Conclusion

Incumbent banks in the US have already started responding to the risk of losing credit card profits through BNPL products, by offering more flexibility of loan terms plus higher capital utilization due to faster loan turnover and lower regulatory capital requirements.

Therefore, to compete with pure-plays, banks may need to build a compelling and scalable business model to cover the entire purchase journey, and not just a financing solution at check-out. Banks can also effectively leverage their existing scale to highlight their ability to drive incremental traffic to merchants. They may need to integrate within purchase journeys, ideally at the PoS. They could also modernize their platforms or license tech from SaaS-based players to compete effectively.

From paper to digital wallets, Aspire System offers advanced capabilities for all your business needs. We can help your bank ace in your digital transformation journey with new age payments solutions, fast and ready-to-go implementations. Know how.

- Temenos-Aspire Systems: Six years of collaboration, cooperation and 50 + successful implementations - April 22, 2022

- Buy Now, Pay Later: A Boost for Banks, Pure-Plays and Businesses - March 17, 2022

- 7 Neobank Trends Traditional Banks should Adopt in 2022 - December 14, 2021

Comments